December 1, 2020

Content

The terms of your contract state that you will hold the annuity for 7 years at a guaranteed effective interest rate of 3.25 percent. You’ve owned the annuity for five years and now have two annual payments left. You can find the exact present value of your remaining payments by using Excel.

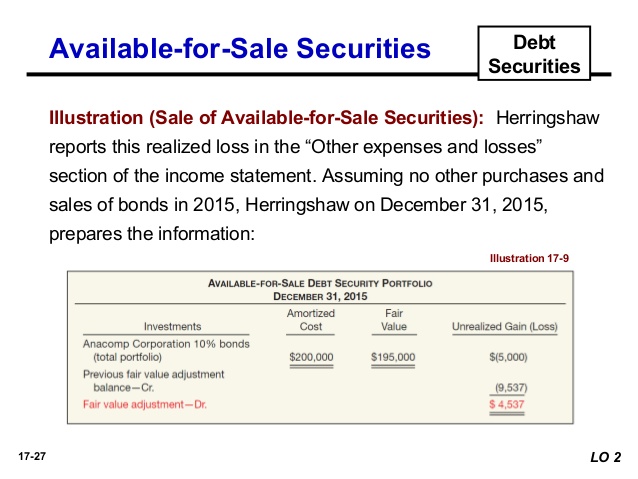

The carrying value of the bond will be $200,000, which is the same as bonds payable. The formula for finding the present value of an ordinary annuity is often presented one of two ways, where “r” represents the interest rate and “n” represents the number of periods. An annuity table provides you with the the present value interest factor of an annuity by which you multiply your payment amount to arrive at your annuity’s present value. Just as you regularly review your credit card statements, bank balances and investments, you’ll want to know the value of your annuity at any given point in time. As any expert in financial literacy will attest, your balance sheet is the foundation for everything from your budget to your retirement savings. Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy.

Given a 7.25 percent interest rate, compute the year 8 future value of deposits made in years 1, 2, 3, and 4 of $1,200, $1,400, $1,700, and $1,700. https://online-accounting.net/ Compute the future value in year 7 of a $2,000 deposit in year 1 and another $2,500 deposit at the end of year 4 using an 8 percent interest rate.

The discount will be amortized over a three-year period using the straight-line method. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

An annuity table, or present value table, is simply a tool to help you calculate the present value of your annuity. Annuity.org carefully selects partners who share a common goal of educating consumers and helping them select the most appropriate product for their unique financial pvoa table and lifestyle goals. Our network of advisors will never recommend products that are not right for the consumer, nor will Annuity.org. Additionally, Annuity.org operates independently of its partners and has complete editorial control over the information we publish.

Annuity – A fixed sum of money paid to someone – typically each year – and usually for the rest of their life. Below you will find a common present value of annuity calculation.

Input your search keywords and press Enter.